Town Tax Collections

Jorene Joyner

Tax Administrator

jmathias@townofsparta.org

jmathias@townofsparta.org

Beginning July 1, 2022, the Town of Sparta will begin billing and collecting tax money due to the Town for 2022 Taxes and beyond.

All prior year Property Tax Collections for both the Town and County will remain with the Alleghany County Tax Office.

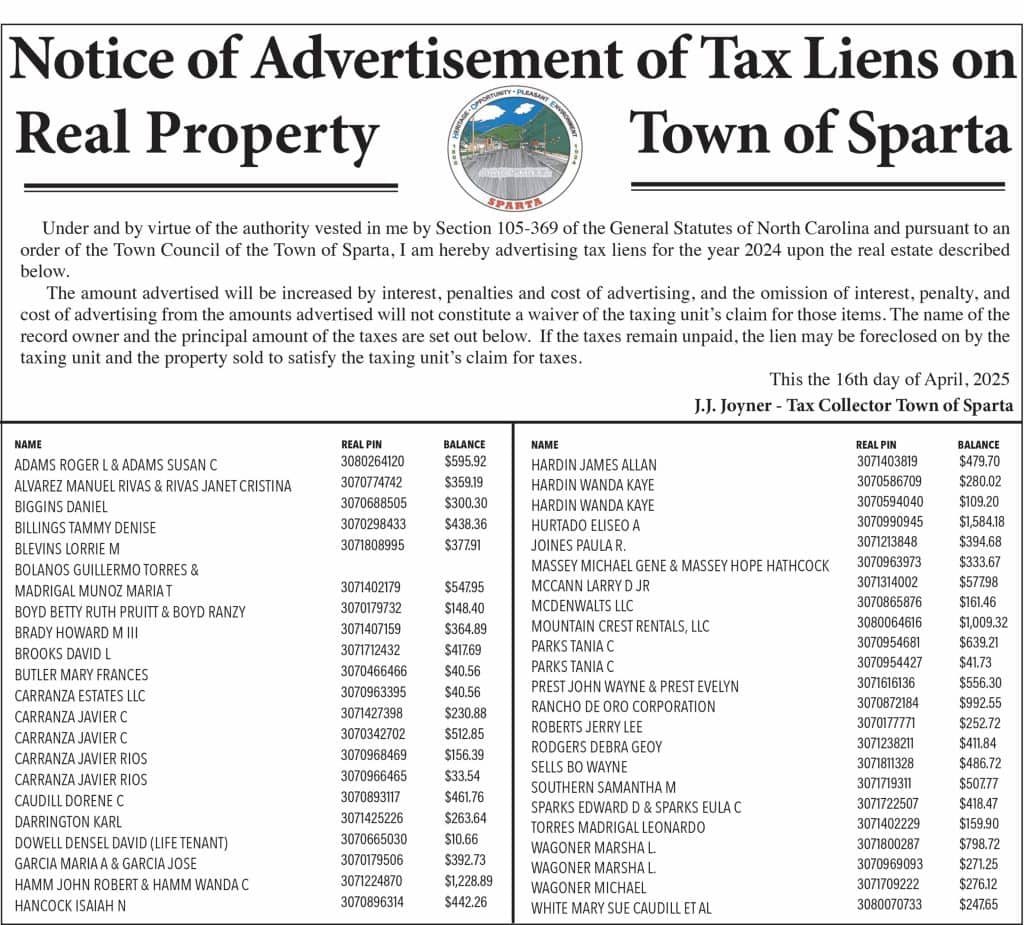

Below is the current list of delinquent taxpayers.

Taxes:

- The Town’s current tax rate is $0.39 per $100.00 valuation of the property.

- All real and certain personal property located within the town limits of Sparta, N.C. are required to be reported to the opens in a new windowAlleghany County Tax Office by January 31 of each year.

- The Town of Sparta does not assess the value to property but the value is determined by and our billing information is received from the opens in a new windowAlleghany County Tax Office.

- All owners of property located within the town limits of Sparta, NC will receive two (2) tax bills generally in August of each year; one (1) from the Town of Sparta Tax Collector, and one (1) from the opens in a new windowAlleghany County Tax Collector. Be careful not to overlook either. Lost, misplaced or undelivered bills will not excuse a late payment – penalties will be assessed.

–

Dates to remember:

- January 1: Taxes are billed to the owner of property as of January 1. Selling property during the year does not relieve the tax obligation of the owner as of January 1.

- August 1 – 31: Taxes paid during this period are eligible for 2% discount.

- September 1: Property Taxes become due and payable.

- January 6: Property Taxes become delinquent and penalties and interest of 2% are imposed on unpaid amounts.

- February and each month thereafter: 3/4% (0.75%) Interest is added on any outstanding balance the first day of each month until the balance is paid in full.

- March 31: This is the last day to pay taxes before the delinquency is advertised in The Alleghany News and posted to the Town webpage.

- April: Property Tax delinquencies are advertised in The Alleghany News and will be posted opens in a new windowHERE. This will begin April 2023.

–

Tax Payment Options:

- ACCOUNT NUMBER IS REQUIRED IN ALL OPTIONS: REFER TO YOUR TAX BILL.

- Mail check(s) payable to the “Town of Sparta” and remit to Town of Sparta, P.O. Box 99, Sparta, NC 28675. Refer to your Tax Bill for required information when submitting payment.

- In Person with Cash, Check, Money Order, VISA, MasterCard at Sparta Town Hall, 304 S. Main St., Sparta, NC 28675, Hours: Monday through Friday, 8:30 am – 4:30 pm. Note: There will be a convenience fee when paying by Credit or Debit card. Refer to your Tax Bill for required information when making a payment.

- Drop Box located beside Drive thru window.

- Online payment– Click opens in a new windowHERE. Note: There will be a convenience fee when paying by Credit or Debit card.

Delinquent Taxes:

- Delinquent taxes will be advertised and an advertising fee will be added to the unpaid bill.

- Delinquent taxes are required to be advertised in the name of the owner as of the date the taxes became delinquent, January 6.

- Enforced collections may begin any time after bills become delinquent.

- Legal remedies for the collection of past due accounts include but are not limited to Garnishment of wages or rents, Attachment of bank accounts, Debt setoff of NC Income tax refunds, NC Lottery winnings or Foreclosure.

–

Gap Tax Billing:

- A Gap bill occurs when there are one or more months (a gap) in billed property taxes between the expiration of a vehicle’s registration expiration and renewal, or the issuance of a new registration.

- The Town of Sparta is responsible for the billing and collecting of taxes on unregistered motor vehicles located within the town limits.

- GAP Tax bill becomes Due and Payable September 1.

- GAP Tax bill becomes delinquent January 6 and penalties and interest of 2% are imposed on any unpaid amount(s).

- 3/4% (0.75%) Interest is added on any outstanding balance the first day of each month until the balance is paid in full.

- Legal remedies for the collection of past due GAP Tax accounts include but are not limited to Garnishment of wages or rents, Attachment of bank accounts, Debt setoff on NC Income tax Refunds and/or NC Lottery Winnings.

For questions you may call Sparta Tax Department at (336) 372-4257, option 5, or email jmathias@townofsparta.org, or write to Town of Sparta, P.O. Box 99, Sparta, NC 28675, Attn: Tax Collection